A recent report by Kaiser Family Foundation (KFF) examined trends in Medicare spending on EpiPens from 2007 to 2014. KFF found that since Mylan acquired EpiPen from Merck in 2007, prices for a two-pack of EpiPens have increased by almost 550%, from $94 in January 2007 to $609 in May 2016.

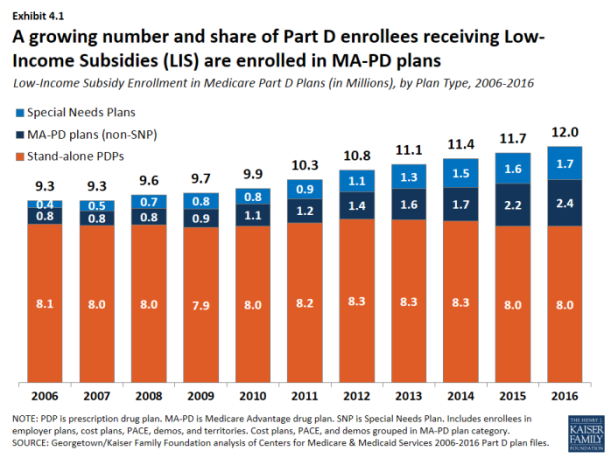

The KFF analysis demonstrated that the EpiPen price increases have translated into higher spending fro Medicare Part D plans, enrollees, and program overall, leading to higher cost sharing and higher premiums for consumers. The average out-of-pocket spending by enrollees for each prescription doubled among non-LIS enrollees, from $30 to $56.

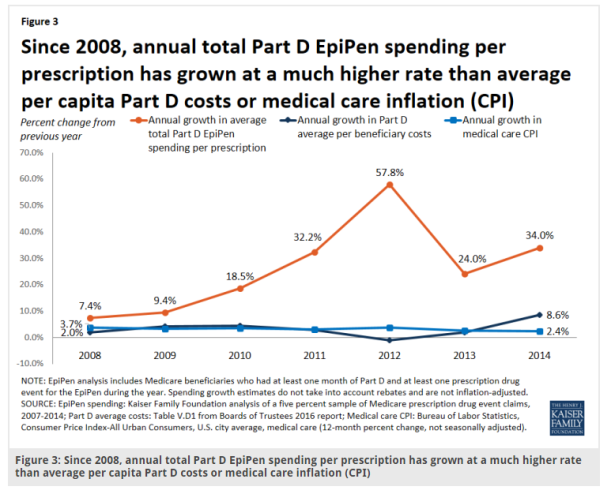

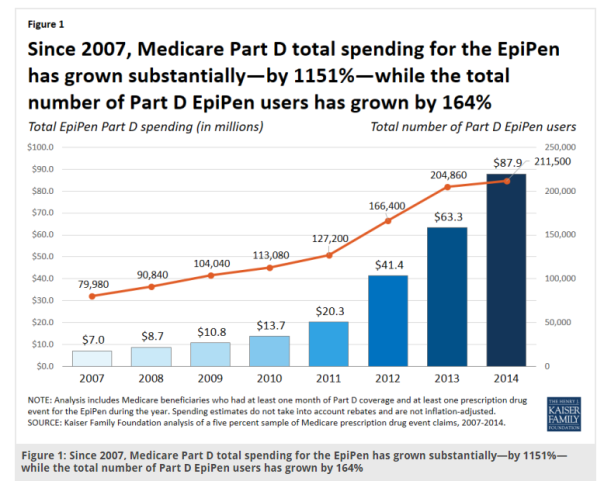

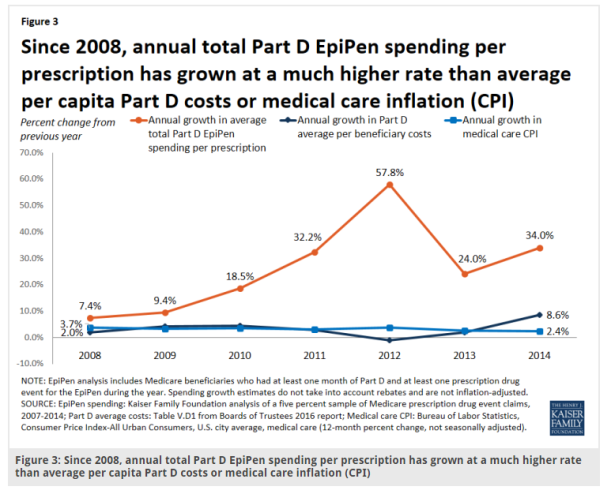

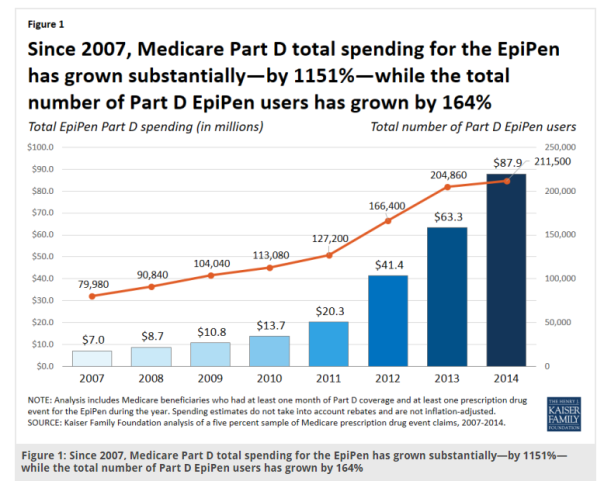

The analysis found that Part D spending increased from $7 million in 2007 to $87.9 million in 2014, an 1151% increase. At the same time, the number of enrollees using EpiPens also increased, but at a much, much slower rate, only increasing by 164%, from 80,000 to 211,000 enrollees.  On a per prescription basis, the average total spending increased by 383%, rising from an average of $71 in 2007 to $344 in 2014, a nearly five-fold increase. Compared to the annual growth rate of Medicare overall (per capita), the annual growth rate for total Part D EpiPen spending (per prescription) was significantly higher. For example, in 2014, the annual growth rates were 34% and 8.6% for EpiPen spending and overall Medicare spending, respectively.

On a per prescription basis, the average total spending increased by 383%, rising from an average of $71 in 2007 to $344 in 2014, a nearly five-fold increase. Compared to the annual growth rate of Medicare overall (per capita), the annual growth rate for total Part D EpiPen spending (per prescription) was significantly higher. For example, in 2014, the annual growth rates were 34% and 8.6% for EpiPen spending and overall Medicare spending, respectively.

A

On a per prescription basis, the average total spending increased by 383%, rising from an average of $71 in 2007 to $344 in 2014, a nearly five-fold increase. Compared to the annual growth rate of Medicare overall (per capita), the annual growth rate for total Part D EpiPen spending (per prescription) was significantly higher. For example, in 2014, the annual growth rates were 34% and 8.6% for EpiPen spending and overall Medicare spending, respectively.

On a per prescription basis, the average total spending increased by 383%, rising from an average of $71 in 2007 to $344 in 2014, a nearly five-fold increase. Compared to the annual growth rate of Medicare overall (per capita), the annual growth rate for total Part D EpiPen spending (per prescription) was significantly higher. For example, in 2014, the annual growth rates were 34% and 8.6% for EpiPen spending and overall Medicare spending, respectively.